Once upon a time, a long, long time ago, in the land of Philadelphia, a scientist, famous only as an author at the time, experimented with a kite, a key, and a thunderstorm.

The rest, as they say, is history.

Benjamin Franklin may not have been the first to theorise about the potential of harnessing electricity. Still, his famous experiment is generally accepted as the catalyst for our journey into the muddy waters of today’s power generation.

The world of power generation has dramatically changed since that day in 1752. Electricity, the harbinger of the industrial revolution, is now a powerful economic driver and no longer a mystical fairy tale.

Before the Industrial Revolution, our energy needs were modest. We relied on the sun for heat and burned wood, straw, and dried dung when the sun failed us. The power of the wind in our sails took us to every corner of the world, and for work, we used animals to do jobs that we couldn’t do with our own labour and water and wind drove the simple machines that ground our grain and pumped our water.

With the low-cost automobile and the spread of electricity, our society’s energy use changed forever. Power plants became larger and larger until we had massive coal plants and hydroelectric dams. Power lines extended hundreds of kilometres between cities, bringing electricity to rural areas.

Energy use snowballed, doubling every ten years. The cost of energy production was declining steadily, and the efficient use of energy was simply not a concern.

South Africa’s growth and diversification

In South Africa, the late 19th century saw rapid change from an agricultural society to an industrial organisation, with the primary driver being the discovery of large diamond deposits in Kimberley in 1867, followed in 1886 by the discovery of gold on the Witwatersrand.

Electricity was publicly used in South Africa for the first time with the opening of the electric telegraph line between Cape Town and Simon’s Town on 25 April 1860. The first electric streetlights, driven by a coal-powered plant, were installed in Kimberley in 1882.

The first central power station and distribution system in South Africa, consisting of a 150kW generator with two boilers at Cape Town Harbour, was completed in 1891 to supply power to government buildings. In 1893, Wynberg, in Cape Town, opened a power station to provide power to a local tram system and public streetlights. Due to the rapid need for consumer electricity and railway electrification, the Electricity Supply Commission (ESCOM) was formed in 1923.

ACTOM sprouting its roots

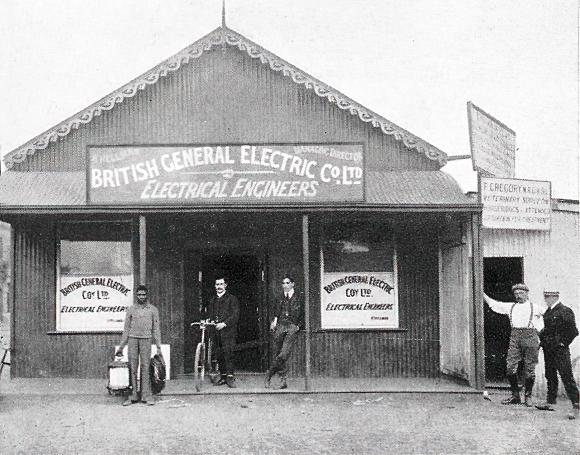

Due to the rapid industrial revolution in South Africa, the British General Electric Company (GEC), a prominent British industrial conglomerate involved in consumer and defence electronics, communications, and engineering, found its African footprint in the Cape of Good Hope in 1903, so, the ACTOM journey began.

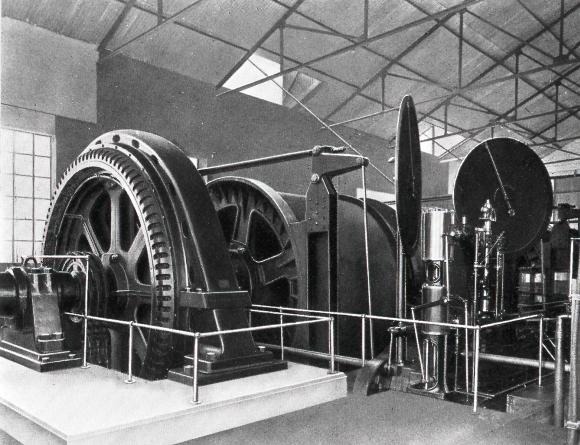

The discovery of diamonds and gold in South Africa started a mining boom that required significant electrical mining equipment and, by default, more power plants. To meet demand, GEC built the first power plant in Uitenhage in 1908 with an order consisting of two diesel-driven 90kW electric generators and switchgear. Within a few years, power stations in three other towns, Oudtshoorn, Queenstown and Stellenbosch, had placed similar orders.

Mergers, acquisitions and liquidations characterised GEC’s next 100 years as the South African market took shape internationally and navigated through wars and political challenges. The importance of local manufacturing became one of the cornerstones that would later position ACTOM as an industry leader.

By the late 1970s, the pressure on multinational companies operating in South Africa to disinvest had intensified, and GEC decided to convert its South African arm from a wholly owned subsidiary to an associate company of its UK parent. In 1978, the UK group sold 50% of the local Group’s equity and management control to Barlow Rand, South Africa’s largest mining and industrial conglomerate.

When economic sanctions were lifted against South Africa in 1991, positive influences increased export and import trade, with many new companies appearing in local markets. By the first democratic elections in 1994, South African manufacturers saw boosted confidence from overseas trading partners and investors. The new South Africa took its place in the world community, which led to the South African government implementing a Black Economic Empowerment (BEE) policy to encourage transformation into the private sector. Multinational companies reshaped and strengthened their South African operation and realised their growing need to bring black equity partners into their local businesses.

In 1996, GEC ALSTHOM South Africa appointed a task team to formulate a strategy for the BEE implementation. In 1998, a partnership was formed with three black empowerment groups, who jointly owned BEE companies in the transformer repair, projects and product distribution fields. The European stakeholder’s name changed to ALSTOM in 1999 after its significant stakeholders reduced their holdings in the Group.

In July 2002, ALSTOM SA (Pty) Ltd was formed, in which the goal of bringing together the four key stakeholders, namely the technology provider, BEE partners, management, and the finance providers as owners of the new entity was realised, making Alstom SA, a South African owned company for the first time - a fitting, and triumphal conclusion to the Group’s first 100 years in South Africa.

Read more about the history in “The first 100 years of ALSTOM South Africa” on the ACTOM website under the newsroom link.

South Africa had experienced strong economic growth since the end of apartheid in the early 1990s, and a profound restructuring of the economy had borne fruit in the form of macroeconomic stability, booming exports, and improved productivity.

The performance of the South African economy in 2004 was encouraging, with growth accelerating above 5% in the second half of the year and enabling ALSTOM South Africa to leverage off the significant growth and establish itself as a leading manufacturer and distributor of various electrical-related products, diesel engines, industrial brakes, and clutches.

By February 2005, the economy had grown more strongly than ever in the previous 20 years. South Africa’s fiscal deficit was reduced from 46% of gross domestic product (GDP) in 1996 to 1,5% in 2005. Not surprisingly, South Africa’s global competitiveness had soared and manufactured value-added products were increasingly eating into commodities as a traditionally dominant share of exports. With the increase in demand for locally manufactured products and Eskom’s drive to implement an aggressive policy of promoting local content, ALSTOM SA committed to invest over R40m in the production capacities of three of their divisions. The capital investment increased production output by approximately 50% by the middle of 2006. According to Mark Wilson, Group Managing Director, ALSTOM SA at the time, “the group had been increasing its manufacturing capabilities over the previous 18 months, strengthening our ability to meet higher local content quotas”.

Business acquisitions

With ALSTOM well positioned as a leading local manufacturer and service provider, the next logical step in establishing the company as the definitive market leader in South Africa, as well as the rest of Africa, was to define a clear growth strategy, both organically as well as through mergers and acquisitions.

The ALSTOM Group experienced unprecedented growth in 2007, with their order intake exceeding R4,5bn and doubling their business growth over the previous three years. This exceptional growth led to ALSTOM acquiring MikroPul SA, a leading air-cleaning and dust control specialist that was renamed Air Pollution Control.

In 2008, ALSTOM South Africa saw significant investments by new majority stakeholders Actis and Old Mutual and substantial reinvestment by all its BEE stakeholders. In 2009, ALSTOM SA’s name was formally changed to ACTOM due to the renewal of partnership agreements between Ariva T&D and ALSTOM. The Group employed, at the time of the name change, more than 6000 people and had an annual order intake of R5bn. The group, consisting of 27 operating units, 22 production facilities and 25 distribution centres throughout South Africa, marked the largest private equity deal and one of the largest ever in the electrical engineering sector in South Africa at the time.

ACTOM continued with its drive to establish a competitive, diversified and market-leading offering of a one-stop engineering solution through mergers and acquisitions of strategically positioned and company-aligned businesses. In line with this strategy, ACTOM acquired Luwa SA in 2011. Luwa, a market leader air-conditioning specialist company formed in 1971, was subsequently renamed ACTOM HVAC Systems and integrated into the John Thompson division.

February 2012 saw ACTOM announcing the acquisition of Savcio (Pty) Ltd, a well-known South African group providing maintenance and repair services for rotating equipment and transformers throughout Africa. The acquisition increased ACTOM’s annual order intake by 40% to more than R7,5bn. It increased the number of operating units from 33 to 42, with the total staff complement rising from 5,400 to 7,500. All the former Savcio divisions, namely LH Marthinusen, Marthinusen & Coutts, Reid & Mitchell, Transwire, Wilec, Metalplus, (Hydron Hydraulics and Electrowave Cape) renamed to ACTOM Energy, all continue to operate within their brand identity under the ACTOM flag. The then CEO and Chairman, Mark Willson, stated, “The acquisition reinforces the group’s ongoing local added value and technology development strategy. Strong partnerships with multinational companies support this approach. It is specifically targeted at supplying technical solutions, but not exclusively tailored to the African Market.”

2012 also saw ACTOM acquiring Genlux Lighting, a leading designer and manufacturer of outdoor and indoor luminaires. The acquisition was significant and underpinned by a technological partnership with a leading international designer and manufacturer of luminaires and 14 established branches throughout South Africa.

In 2014, Marthinusen & Coutts (M&C) extended its service offering with the acquisition of Cetus Turbo Machinery, which is currently being complimented by adding a comprehensive repair service to electric motors and generators within the division and was later renamed ACTOM Turbo Machines. Today, ACTOM Turbo Machines specialises in inspecting, repairing, and refurbishing both OEM and non-OEM rotating equipment.

In July 2016, WPI Power Solutions, a Gauteng-based company specialising in the repair and maintenance of electrical networks, was incorporated to boost ACTOM’s electrical maintenance offerings in their MV Switchgear division and brought with it extensive experience and expertise in undertaking large-scale projects involving preventative maintenance and repairs of networks.

In October 2018, ACTOM consolidated its Namibian operations, Namibia Armature Rewinders (NAR) and Electrical Products Namibia (EPN), into a subsidiary business unit of ACTOM Energy Namibia. Based in Swakopmund, NAR repairs electric rotating equipment, while EPN, based in Windhoek, operates as a sales-and-service branch for Electrical Products. This change consolidated the management and financial administration of the two businesses under one holding company, enabling them to operate more efficiently. The merging of the two subsidiaries led to improved competitiveness and targeted broadening of their scope of business activities in Namibia’s rail, mining, and power sectors, with the potential that ACTOM’s other divisions could cater to new projects.

In August 2023, ACTOM acquired a low-voltage electrical manufacturing facility in Kenya, which is seen as an entry point into East Africa, where the company plans to target Tanzania, Uganda, Rwanda and Ethiopian markets. This facility will also provide equipment repair and maintenance and offer attendant services. The idea is to transfer ACTOM’s technology into Kenya, where significant growth opportunities exist. ACTOM Group Chief Executive, Mervyn Naidoo emphasised the potential of this factory as being immense and strategically aligned with the group’s drive to expand further into Africa.

Growth strategies & initiatives

At the G20 summit in Australia in 2014, South Africa delivered its economic objectives over the short and medium term, anchored around the National Development Plan (NDP), released in 2011. It outlines South Africa’s objectives for development up to 2030 and provides a diagnostic overview of critical blockages to development. The Medium-Term Strategic Framework (MTSF) for the period 2014-19, released in 2014, offered key interventions to prioritise key policy actions to be undertaken in the next five years. South Africa’s growth strategy, which is aligned with the NDP and MTSF, aims to improve the environment for growth in employment, investment in infrastructure, trade and competition. In supporting the South African government with its objectives, ACTOM has made significant progress since 2002 in growing its infrastructure; the progress, however, did not come without challenges and setbacks.

During 2017, ACTOM faced environmental challenges due to political and policy uncertainty, loss of business confidence, and a loss of trust between businesses and the government. This created a toxic environment for further investment in infrastructure and resulted in forced restructuring, consolidation, and unavoidable retrenchments throughout all divisions.

ACTOM sold off its Elmacast foundry in 2017 following a strategic decision to outsource castings.

In 2018, ACTOM restructured its interests in TLT ACTOM which resulted in ACTOM acquiring the fan services business, which it integrated into its LH Marthinusen (LHM) Division. This was part of a strategy to extend into draft fan services at ESKOM’s Power stations. This strategic repositioning led to LHM being awarded a major draft fan repair contract by ESKOM in 2021.

In 2019, Wilec, a key supplier of input materials required by several of ACTOM’s divisions, was sold to Makarenge Electrical Industries (MEI), a wholly black-owned company. The disposal of Wilec formed part of the Group’s growth strategy to review its extensive vertical integration of copper processing. The transaction demonstrated ACTOM’s commitment to government policy of encouraging the development and advancement of black industrialists where merited.

Exports

With intensified competition from imported products, particularly from China and other Southeast Asian countries, local manufacturing became increasingly difficult. However, the weakening rand brought increased opportunities for ACTOM to develop and expand their locally manufactured product offerings into international markets.

ACTOM, to retain its competitiveness and increase its market share, started to focus abroad and saw a surge in profits due to increased orders from the United States, Australia, and Indonesia. ACTOM implemented a bold export incentivisation programme in 2014 as a key part of their group-wide strategy to boost business growth in the medium term and sustained expansion in the longer term. The decision to expand internationally became instrumental to the group’s drive to concentrate on its African footprint and grow cross-border exports to neighbouring countries. The decision yielded significant results, and R1,56bn in export orders were generated by the end of the 2014 financial year, which was 67% higher than the previous year.

One of their many success stories and the group’s main strategies is diversifying geographically. Most of ACTOM’s divisions and business units recognise that African countries offer the best opportunities for export and growth and, therefore, direct their efforts mainly at expanding and developing in these countries. ACTOM believes in developing a strong export sales pipeline and actively promotes export opportunities through its association with Proudly South Africa and their membership with the South African Electrotechnical Export Council (SAEEC). “It is important for us to partner with organisations that help drive investment, promote locally manufactured products and break down barriers to international trade. We support the efforts of those finding ways to confront, and more importantly, to resolve, the issues underpinning the current economic crisis we find ourselves in. We realise there is no quick-fix solution, but we are confident that we are on the right track,” commented ACTOM’s Chairman, Andries Mthethwa.

With their various partnerships and operations in 31 African countries, there is no doubt that business opportunities exist outside South African borders. Their unified approach offers excellent advantages for the Group and their business units, especially with the cost savings achieved, providing a more competitive deal overall. ACTOM’s geographic diversification strategy is continually being reviewed and adapted to strengthen its local manufacturing arm.

Local manufacturing

Export opportunities are high on ACTOMS’s agenda, and their strategy for local partnerships and role in developing the country’s critical infrastructure are taken extremely seriously. The Minister of Energy’s announcement in 2017 that the government needs to support and intervene to protect and stimulate the local manufacturing sector was a positive turn for the Group. Between 2013 and 2023, ACTOM invested approximately R1Bn in capital expenditure in its local businesses to boost manufacturing as well as aftermarket repairs and services.

ACTOM, with its long manufacturing history and various divisions, has expanded to offer world-class manufacturing facilities. John Thompson, with a manufacturing facility in Bellville, South Africa, has a total of 30,000m2 under one roof and is Africa’s leading supplier of industrial boilers.

ACTOM’s Power Transformer division has been manufacturing power transformers for nearly 60 years and supplies to electricity distribution utilities, the mining sector, industrial plants, public works authorities and turnkey contractors. ACTOM ensures they only import what they must and manufacture the balance of products locally. This is an integral element of their strategy to create employment and promote local manufacturing.

With South Africa on the cusp of the Fourth Industrial Revolution (4IR) and the uncertainty of what it means for local manufacturing, ACTOM restructured a few of its divisions to meet the new market demand and created ACTOM Smart Technologies, which focuses explicitly on enabling the Group to embrace 4IR. Many of the ACTOM businesses have already been proactive in implementing automated processes and exploring new and diverse manufacturing opportunities for the future. Some of ACTOM’s businesses have initiated case studies on automation to identify what and how this could negatively affect their businesses. The Group is cognisant of the fact that the business landscape is changing rapidly and brings with it enormous responsibility in stimulating employment. “By creating jobs, we remove the social burden of unemployment and associated issues”, said Mervyn Naidoo.

Localisation and designation

According to Stats SA, South Africa is expected to register the highest unemployment rate in Africa in 2024, a statistic that is tragic and requires that companies formulate growth strategies that are aligned with growing localisation and supporting communities across South Africa, sustainable labour and recruitment is and must be a priority.

Building local industrial capacity for the South African market has become a priority for the Department of Trade Industry and Competition. It highlights a growing need for organisations to promote localisation within the manufacturing sector. This is a crucial step towards reducing unemployment, improving skills development, and enhancing local demand through high-quality services and solutions. In addition, it serves up local ingenuity and solutions to the global market as local capacity equals growth for export markets and encourages a move away from the exclusive provision of raw materials.

The government has had this focus in place for nearly ten years and has, in that time, seen the development of solutions for the local market and identified several key sectors that require a significant shift towards local manufacture – the government has to date earmarked 27 of these sectors and continues to drive this narrative in 2023.

The importance of the narrative cannot be ignored or circumvented, particularly in light of the slow growth in the manufacturing sector, which decreased by 2.3% in May 2022 compared to the same time in 2021 and by 4.7% in December 2022 compared to December 2021. These figures highlight a distressed sector that requires consistent investment and strategic support to ensure measurable growth in 2023. In a recent interview, Naidoo, who is passionate about localisation and designation, said, “Localisation has a serious impact on the whole supply chain. When you localise manufacturing, all the sub-components of manufacturing fall into place and benefit communities.”

ACTOM is actively involved in localising its products and services and offers on-the-job training on construction skills, including bricklaying, plastering, painting, concrete formwork, cable terminating and electrical wiring. While the site crew’s engagement is only transitory and for the duration of any project, the skills transferred can improve their future employability prospects and possibly even inspire some to go into business.

ACTOM commits to a greener future

Eskom’s Just Energy Transition (JET) Office was established in 2020 and has made significant strides to progress the evolution of the transition towards a cleaner and greener energy future. JET’s vision focuses on achieving “Net Zero” carbon emissions by 2050, with an increase in sustainable jobs. Traditionally, ACTOM has been geared toward coal-fired power stations but has realised that, with Engineering Procurement Contractors (EPC) requiring integrating offerings, they must migrate towards evolution engineering in new design technologies. With renewable power plants scattered across South Africa, applying condition monitoring to individual systems was tricky. ACTOM thus invested in developing new software, systems and technologies that allow users remote access – yes, you can be sitting in Johannesburg whilst having live access to the management and maintenance systems of a plant in the Karoo.

It was reported that in September 2023, South Africa had 34 operational wind farms, adding a combined capacity of 3,400 MW to the South African electricity grid. The Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) implemented in 2011 has awarded 123 projects to the private sector, with a total investment committed of R256bn. Four of the six bid windows have come online, totalling 6200 MW installed capacity.

All building systems and components require maintenance, and renewable energy systems are no exception. It should be a rule that all renewable energy systems practise proper annual care to ensure efficient power delivery and distribution. ACTOM Energy, a project business with front-end engineering capabilities and technical expertise, is well positioned and geared towards capitalising on the many opportunities with greener electricity generation locally and globally.

Sustainability

In 1987, the United Nations Brundtland Commission defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

The economy of South Africa is beset by poverty and inequality, considerable unemployment, carbon-intensive, water insecurity, and slow GDP growth. Furthermore, the COVID-19 epidemic has caused the economic crisis to worsen further. It emphasises the need for a new development strategy to spur economic recovery.

According to the Daily Investor, elevated levels of load-shedding so far in 2023 could cost the South African economy R1.6 trillion in lost economic activity – R400 billion more than last year. The JET programme allows ACTOM growth and sustainability for most of their divisions and business units and reflects on the group’s adaptability to manufacturing and supporting the industry while at the same time implementing initiatives to migrate away from carbon energy production. With their market-leading technologies and product advancement, ACTOM is well-positioned to offer large-scale infrastructure installations to smaller projects and services.

It is one of the first manufacturing companies to provide a complete turnkey power island solution in South Africa. Simply put, the concept means the independent operation of a whole network or part thereof can be isolated after it becomes disconnected from an interconnected system. ACTOM custom designs and manufactures medium voltage motors and prides itself in offering every element of a power island.

ACTOM celebrating 120 years

From humble beginnings as a European-based company all those 120 years ago, ACTOM today can stand tall and proud as a truly South African company that is fully invested in local economic and community growth. A company that is proudly a Level 1 B-BBEE Contributor with 52.89% black and 35.64% Black Women ownership, sporting a staff complement of more than 6800 employees, and have an annual order intake of more than R11bn.

At their recent 120-year celebration ceremony, ACTOM hosted Dr Robert Nkuna, Director General in the Presidency; Sivuyile Ngodwana, Mayor of Ekhurhuleni; Stakeholders and guests. “This event was a celebration of a legacy company that is over a century old, and the fact that we have managed to navigate multiple industrial revolutions, technology changes, a pandemic, and economic cycles and survive by reinventing the company is testimony to our strength. This event aimed to celebrate what we’ve achieved and the people who have been involved in helping us reach this achievement,” said Mervyn Naidoo.

.jpg)

According to Andries Mthethwa, who started his career at ACTOM (GEC) in 1976, when asked about the future of ACTOM, he said, “I strongly believe that the tried and tested key drivers can continue to grow the company in the future. We need to continue with the training of the new generation of employees, and we need to embrace and promote new technology as we go forward.”

However, having a 120-year-old historical legacy should not define a company; what should define us is how we navigate the future and build the next 120 years. True ongoing success can only be achieved by embracing the philosophy of “Stewardship”. A simple philosophy is that we own nothing - everything we have is loaned to us. Our only responsibility is to ensure that when we do hand over the responsibility, it is in a better condition than when we first received it. ACTOM’s true legacy is in what comes next and how we ensure that the company and our country are handed to the next generation in the best sustainable condition possible.